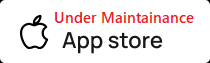

All you need to do business globally. Global Business Banking with International Bank Accounts.

Avoid the pain of managing payments and finances across multiple disconnected software providers. With Airwallex, you get a single unified platform, engineered with all the powerful features you need to streamline and future proof your business growth.

Open An AccountForeign Currencies

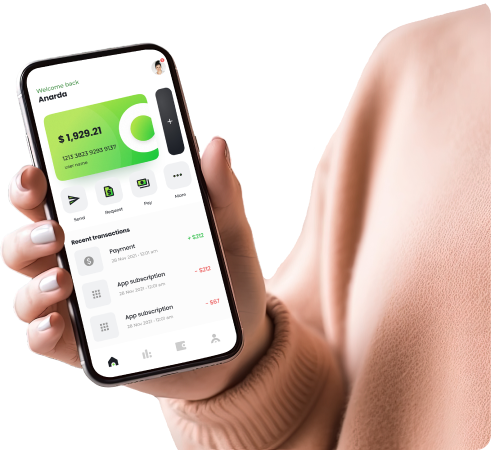

Open Bank Accounts in 20 global currencies. Send money across the world in 47 currencies.

Get StartedInternational Bank Accounts

Open Bank Accounts with NL, DE, FR, ES or more. Always get the best exchange rate abroad.

Get StartedLooking to expand your business and scale globally?

Look no further. We're not just a bank, we're a game-changer.

Get StartedForeign Currency Savings Accounts

Earn 11,25% interest by investing. We're revolutionizing financial services for a globalized world, leaving traditional banking and outdated software behind.

Get Started

The process is simple and straightforward: keep the things on this list close to you.

To open a small business account, you can follow these general steps

Gather required documentation

Tax certificate from your your country of business registration.

Personal ID: Driver's license, passport, or state ID for all signers.

Business License/Permits: Any required local or state operating licenses.

Business Address & Contact Info: Physical address (not a P.O. Box) and phone/email.

Corporation: Articles of Incorporation, Certificate of Good Standing.

Partnership: Partnership Deed, registration certificate (if registered), names/addresses of all partners.

Complete the Online Application

Start Online: Go to our online banking portal.

Fill Forms: Provide personal details, business information, and ownership percentages.

KYC verification: Scan and upload your prepared business formation, licensing, and ID documents

Verify Identity: Complete email/phone verification and possibly identity verification.

Fund & Activate

Make Deposit: Fund the account with the minimum required deposit, of not less that $100.00, via online transfer.

Wait for Review: The bank will review your documents; once approved, your account is active and your business debit card is mailed.

Over 100 million in capital and more than 50 investors

Gain a competitive edge with LGM global

Seamless Foreign Currency Transfers for your business

Send payments in 25+ foreign currencies directly from your Euro business account—no extra steps needed. Enjoy full transparency with low fees and real-time exchange rates, so your currency transfers are fast, cost-effective, and surprise-free.

Open An AccountGet the best exchange rates for business spending abroad

Get the best exchange rates for business spending abroad

With ZeroFX, use your LGM global card abroad and get the best value on non-Euro transactions. While traditional banks charge high extra fees for using your card in foreign currencies - we don't! Instead, to protect you from currency fluctuations, and give you the best possible rates, we add a 0,5% mark up to the latest rate when markets are open.

Open An AccountA solution designed for small and medium enterprises. Find out if you can apply for €25,000 up to €3,000,000.

Quick access to funds: Their fast approval and funding process means businesses can receive funds in as little as one to three days.

Flexibility:These loans can be used to cover various operational expenses, and their short repayment periods make it easy for businesses to get back on track fast.

Minimal collateral requirements: Since these loans require little to no collateral, businesses reduce the risk of asset loss.

Cash management solutions After submitting your application, you will typically receive a confirmation that your application has been received. We will then review and process your application.

Experience helps your small business grow

Travel with your Business Card

Enjoy peace of mind with a free travel insurance in the LGM global Elite Business plan. You also get 4x2GB eSim data every year to stay connected when abroad.

A Global account for a Global Economy

In today's interconnected world, your business might span multiple countries and currencies. LGM global is designed for the global entrepreneur, offering easy access to accounts in various currencies and seamless international payments.

Banking with a Conscience

At LGM global, they believe that banking can be a force for good. That's why every time you use your LGM global card, you're contributing to reforestation efforts globally. It's a small way to make a big difference, aligning your financial choices with your values.