International Bank Accounts and Foreign Currencies

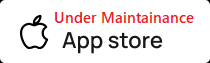

Bank like a local, wherever you are. Open International Bank Accounts with NL, DE, FR, ES, or IE IBANs and send, receive, and hold money in 20 global currencies with ease. The global payments and banking platform for growing businesses Over 200,000 companies around the world trust LGM global to grow their revenue. Open global business accounts, accept payments, manage company spend, and much more - all on one unified platform.

Global Multi Currency Account

Global Investment Banking

Crypto Account

Business Banking

Your financial universe on one platform

International Bank Accounts

We offer international IBANs for 15+ countries, with more on the way! You'll automatically receive an USA, South Africa, Canada, Oceania, and more based on your location, but you can also open additional bank accounts and choose the IBAN that works best for you.

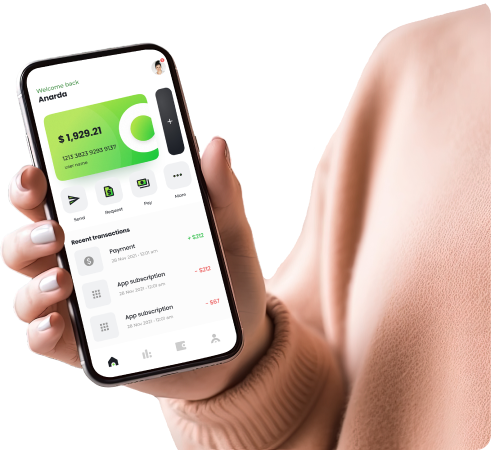

Foreign Currencies

Add dedicated bank accounts to your bunq app and manage your money effortlessly. Spend, receive, and hold funds in 19 foreign currencies, all with an international IBAN and competitive exchange rates.

Foreign Currency Transfer

Easily send money to anyone in 47 foreign currencies, directly from your Euro account. You’ll see our low transaction fee and competitive exchange rate upfront, so there are no surprises later.

Get the best exchange rate with LGM Open An Account Now

Ready to get started with global banking quickly.

LGM global combines the comfort of mobile banking with true sustainability. We use smart technologies that make your daily life easier while contributing to a better future.

Open Your LGM Account

Sign up for a free LGM global account.

Order the Card

Order the physical card for a one-time fee (around $5 USD).

Fund Your Account

Add money to your account in your home currency. Spend Globally: Use your debit card to pay, and LGM automatically converts from your balance at the best rate or converts funds for a small fee if needed.

Get the best exchange rate abroad

Use your LGM card abroad

With ZeroFX, use your LGM card abroad and get the best value on non-euro transactions. While traditional banks charge high extra fees for using your card in foreign currencies—we don't! Instead, to protect you from currency fluctuations, and give you the best possible rates, we add a 0.25% mark up to the latest rate when markets are open.

View MoreEarn interest on Foreign Currencies

Earn high interest across 25+ global currencies with bunq. Get up to 3.01% annual interest on USD and GBP, and up to 11.25% monthly interest on selected global currencies like USD, Euro, and ZAR—all paid out weekly.

View MoreDo business, locally and globally

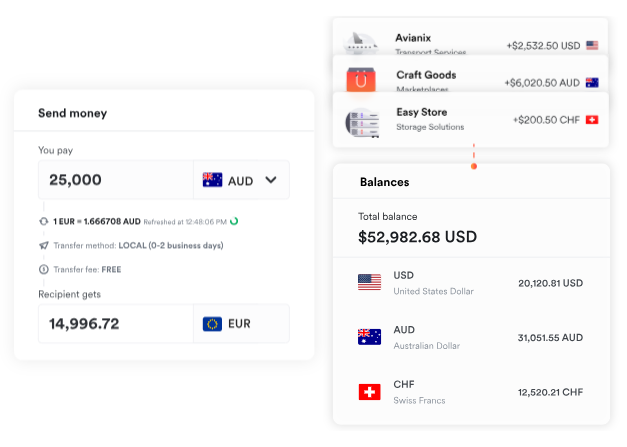

Avoid the pain of managing payments and finances across multiple disconnected global business providers. With LGM global, you get a single unified platform, engineered with all the powerful features you need to streamline and future proof your business growth.

View MoreTo know more about beja bank account details. Open An Account Now

Radically save time and cost

Experience remarkable speed and efficiency. Accept payments in local currencies, make high-speed transfers, and safeguard profits with like-for-like settlement, access to interbank FX rates, and no hidden charges on corporate expenses.

Tap into the world’s local payments network

LGM global proprietary local payments network offers you a faster, more cost-effective, and transparent alternative to legacy banking. Operate like a local business from anywhere in the world – open accounts with local bank details in minutes, accept payments in local currency to avoid costly forced conversion fees, hold funds in a multi-currency wallet, convert currencies at interbank rates, and make high-speed transfers around the world in a few clicks.

180+

Countries from which you can accept payments

$235B+

Global payments processed annually

120+

Countries to which you can make local transfers

Popular LGM global account FAQs

With LGM global, you can hold money in 25+ currencies, and convert between them at the mid-market rate whenever you need. It’s free to sign up, and there are no monthly fees. Learn about pricing here. You can get account details for USD*, GBP, EUR, AUD*, NZD, CAD, HUF, RON*, and SGD — with more currencies on the way. Share these details with your friends, companies or customers to get money from around the world. You can also receive money without sharing your bank details. You can send money that's in your LGM global account to a bank account outside of LGM global whenever you like. We’ll charge a fixed fee and a conversion fee when you send to a different currency. Sending and receiving money between LGM global Accounts in the same currency is free. You can spend money in different currencies around the world with the LGM global card and get low conversion fees — check this on our pricing page. For the most up-to-date pricing and fee information, please read our Terms of Use for your region.

Yes, you can only open LGM global Account to represent yourself, and not on anyone else's behalf. You can read through our Customer Agreement for your region to understand how it works better.

No, you can only have your own personal individual account. We don't offer joint accounts in LGM global, so each user should have their own.

Once you've set up your personal and business account(s), you can get started on a LGM global Account where you can hold over 40+ currencies. Just click on Add a Currency, and follow the instructions. Just click on Add money and follow the instructions. The first currency that you add will be automatically added to your main account. You can add as many currencies as you like to your main account. You can also open jars and groups to keep money separate from your main account. You can also use jars and groups to hold the same currency in two different places. For example, you could have GBP in your main account for spending, and you could also have USD in a jar that you’re putting aside for something later.

We offer the LGM global debit card that lets our customers spend in 150+ currencies worldwide with low conversion fees. You can get a LGM global debit card if you have LGM global Account with multiple currencies.

You’ll have to register and create an account with LGM global. Just share your email address, create a password, choose if you want to open a personal or business account, share your phone number for 2-step verification, and tell us the country you live in. For your personal account, sign up with your legal name, date of birth and address. For your business account, we'll need your business tax identification number, and your business registration address. LGM global may request additional documents to verify your identity or business.

No, you can only have one personal LGM global account. You'll need to open separate LGM global business accounts for every different legal entity.

A personal account should only be used for personal transactions. A business account should only be used for business transactions, even if you're a freelancer or a sole proprietor.

Yes! You can add as many different currencies to your LGM global account as you like. You can add currencies to your main account, and also to any jars and groups you open. You can also convert currencies at the mid-market rate and at a low fee.

Sending money that you have in your LGM global account is faster than sending from a bank account outside of LGM global — and for transfers over 1,000 GBP or its equivalent in other currencies, the fees are lower, too. Learn how much it costs to withdraw or send money that's in a LGM global account Before you start, you’ll need to open an account and make sure you have enough money there to make your transfer. Here’s how to add money. There are 2 ways to start a transfer using money that’s already in your account: Go to one of your currencies and send money from there From the Home tab, choose the currency that you’d like to send from. You can select and then send from any currency that’s in your main account, or in a jar or group Click Send Select who you're sending to and enter the amount you want to send Click Confirm and send — you may need to enter your LGM global password, or use fingerprint or facial recognition, to finish sending money. Set up a transfer and choose to pay with money that’s in your account From the Home tab click on Send Set up a transfer by going through the standard transfer steps At the payment step, choose the currency that you want to pay with. When sending money using the Send button on the Home tab, you’ll only be able to send from currencies in your main account. You may need to enter your LGM global password, or use fingerprint or facial recognition, to finish sending money Here’s what to do if you’ve forgotten your password Direct debits If you want to give a company permission to take regular payments from your account, such as for rent, subscriptions, or recurring bills you can set up direct debits for AUD, CAD, GBP, EUR, and USD in your main account.